These differences that increase the application of the repatriation tax and reduce the territorial DRD concurrently increase and narrow pre-existing subpart F concepts, giving clear proof of a failing to collaborate the arrangements in TCJA’s supposed legal system. The other international TJCA stipulations not at problem in these two situations further show the lack of a systematic legal scheme.

A brand-new tax routine for expatriating individuals was taken on in 2008, as part of the HEART Act. 8 Section 877A provides for a mark-to-market tax on the web gain in property of expatriating UNITED STATE people, generally used as though the individual’s residential or commercial property were sold at its reasonable market price on the day before expatriation.

Strict textualists will counter, nevertheless, that the regulatory give should not be able to ignore the difference in wording also if its impact is to supply an unreasonable advantage not intended by Congress. Better, even though Congress showed unnecessary haste, consisting of without the benefit of any kind of hearings or the ability for legislative representatives, their teams, as well as the tax committees appropriately to look at the legal language, it can be suggested that the drafters should have been conscious of the different phrasing of the effective dates, the typical usage of instead than fiscal year as the taxable year for C firms, as well as the space in time developing the advantage due to the fact that of the distinction in phrasing.

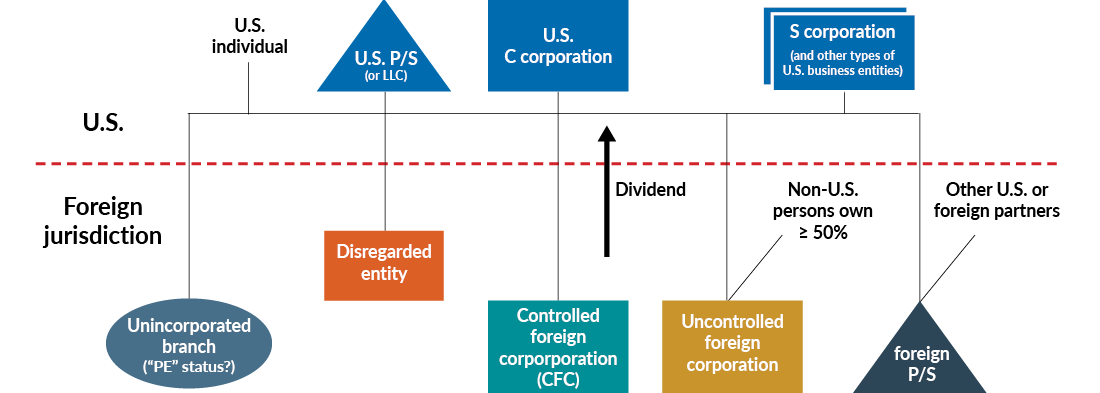

Consequently, unless specific UNITED STATE shareholders make an area 962 political election,17 the GILTI amount will certainly go through tax at their private rates without the benefit of indirect foreign tax credit histories or the GILTI reduction (described in the following section). Sometimes they would certainly be eligible for reduced rates on certified rewards.

III. The Laws Are Much More Disjointed In Freedom Global Inc. v. United States, No. 1:20-cv-03501, Liberty Global suggests that the section 245A policies are invalid and contrast the managing statutes. It insists that the regulations poorly refuse the area 245A territorial DRD since that disallowance is not found in or supported by the statute.

Corporate Tax Revenue – Joint Committee On Taxation in Waukesha, Wisconsin

Founded in 2015 and located on Avenue of the Americas, in the heart of New York City, International Wealth Tax Advisors provides highly personalized, secure and private global tax, GILTI, FATCA, Foreign Trusts consulting and accounting to many clients worldwide, including: Singapore, China, Mexico, Ecuador, Peru, Brazil, Argentina, Saudi Arabia, Pakistan, Afghanistan, South Africa, United Kingdom, France, Spain, Switzerland, Australia and New Zealand.

The taxpayer advantage Treasury cases was unintentional stems from the reality that section 245A relates to circulations after December 31, 2017, whereas GILTI is efficient for the first tax year beginning after December 31, 2017. The varying efficient date language, likely an implicit tax cut, causes a benefit for companies with taxable years that are not calendar years.

Why does Treasury assume section 245A should not be used based on its actual significance? A C firm with a non-calendar fiscal year.

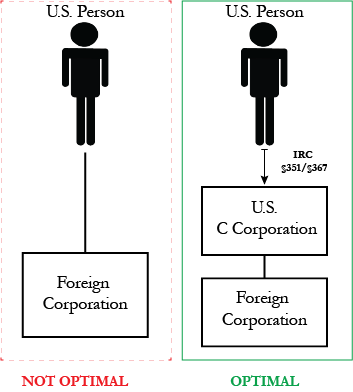

22 Nevertheless, in my view the section 245A guidelines moot are in no way “suitable to accomplish” the section’s stipulations. As displayed in this evaluation, Subpart F, GILTI, and also section 965 do not put on the exact same taxpayers as area 245A nor does section 245A need the international firm to be a CFC.

It hence seems most likely that courts will locate Treasury Regulation section 1. 23 It is my view that Treasury can not exercise its optional authority to draft guidelines to cover up errors that need to have been attended to with legislative technological adjustments, even if the only way the TCJA can be restored as a practical worldwide corporate system was for Treasury and also the Internal Revenue Service to prepare regulations to complete the law.

Inevitably, it is taxpayers who will birth the burden of the TCJA’s straining provisionsnot only by translating the burdensome guidelines propping up the brand-new legislations yet also by predicting which regulations the courts are most likely to revoke as overreaching. This is why within days of the launch of the momentary DRD laws, specialists advised that the participation exemption anti-abuse policy would spur lawsuits – form 5472 instructions.

Managing The Us Tax Impact Of Highly-taxed Foreign Subsidiaries in Conway, Arkansas

This short article suggests consequently that the short-lived and also suggested section 245A laws ought to be discovered invalid. Treasury must not be able to utilize its interpretative authority to expand the GILTI fine tax in policies promulgated under a Code arrangement intended to supply a 100-percent reduction to produce a territorial tax system.

Taxpayers will undoubtedly challenge the laws in the courts, as well as it is practically particular that taxpayers will certainly prevail. Congress must act now to treat the legal TCJA mess.

Disclaimer: Explanations on the terms are extremely condensed as well as may not be total.– A reduction in the assessment of tax, penalty or interest when it is established the evaluation is wrong The teaching which allows the tax authorities to neglect a civil regulation form used by the taxpayer which has no industrial basis Approach of depreciation under which taxpayers might designate larger devaluation deductions to the initial year or very first couple of years of helpful business assets, such as plant as well as equipment– Approach of computing quantities subject to earnings tax as well as VAT.

It generally consists of expenses of the headquarters workplace and accountancy expenses.– Office frequently located in a country besides that of the headquarters workplace, the parent business or nation of operation.– A plan that determines, in development of controlled purchases, an ideal collection of criteria (e. g. technique, comparables and also proper modifications thereto, important assumptions regarding future occasions) for the decision of the transfer rates for those purchases over a fixed amount of time.

Dependent company constitutes an irreversible establishment for the various other business and the income attained through the company is strained on the income earned from the nation where the company is situated whereas independent agency does not.– Term used to signify the including together of the taxpayer’s revenue from all sources in order to establish the relevant tax price for earnings tax functions.

Specified Foreign Corporations & Controlled Foreign … in Petaluma, California

In basic, most countries do not differentiate in between nationals and also aliens for tax functions; instead tax obligation is based on residence and/or residence.– Term typically utilized to explain the transfer of the right to receive income from a source while not necessarily transferring the possession of that resource to the exact same individual.

— See: Advance Pricing Setup– Among the methods utilized to allot income and also expenditures in between relevant ventures using a formula contained some factors such as sales, residential or commercial property, or pay-roll.– Process of getting a commodity (which might consist of money or safeties) as well as simultaneously marketing it in one more market in order to make money from rate differentials.

e. to obtain benefit from the application of tax regulations).– Term utilized for the resolution of a conflict by the judgment of one or more persons, called mediators, who are selected by the events and that normally do not come from a regular court of skilled jurisdiction– The worldwide standard which specifies that, where problems between related business are different from those between independent ventures, profits which have built up because those conditions might be consisted of in the earnings of that business and taxed appropriately– A term used in transfer prices to define a variety of worths that can be Specified Foreign Corporation for objective of choosing a proper arm’s length cost from comparable purchases.

— Act of computing the tax due– Usually speaking, enterprises are linked where the exact same persons take part directly or independently in the administration, control or resources of both enterprises, i. e. both ventures are under typical control.– Regulations that develop ownership by attributing supply to one party although the shares are legitimately possessed by an additional celebration; typically called useful ownership of supply.

— A term that is hard to define but which is usually used to describe the setup of a taxpayer’s events that is meant to minimize his tax liability which although the plan can be strictly legal it is usually in contradiction with the intent of the regulation it claims to comply with.

Dividend Repatriations By Us Multinationals – National … in Kokomo, Indiana

— A repayment, usually from several participants to one more, to adjust individuals’ in proportion shares of payments, that boosts the value of the payments of the payer as well as decreases the value of the contributions of the payee by the quantity of the settlement, in the context of CCA (Price Contribution Plans) – form 5472 instructions.

monitoring services) or are utilized to channel specific revenue, such as rewards, interest, royalties as well as charges.– Term made use of in capital gains tax regulations to denote the cost of a possession to an owner.– Supplies, bonds, etc. in which ownership can be transferred from one owner to an additional without enrollment of the transaction by the releasing firm, that is, title passes with delivery.

Usually essential in tax treaties, as a resident of a tax treaty partner might be refuted the advantages of certain minimized withholding tax rates if the valuable proprietor of the rewards etc is local of a 3rd country.– The person that obtains or is to get the advantages arising from specific acts.

— Term which describes incomes, normally from employment, aside from in cash, as component of payment for solutions rendered.– In thinking about whether a company might be enabled to subtract, as a cost, settlements made to a relevant company in an international team on account of expenditures sustained by that relevant company in giving intra-group solutions, tax authorities would decline a reduction unless a genuine benefit had actually been conferred on the company asserting the deduction.

— The worth of private property as tape-recorded in the accountancy documents of a taxpayer, computed as real price much less allowances for any depreciation– Term utilized about graduated system of taxation to refer, for instance, to the slabs or slices of taxable revenue based on specific rates of revenue tax.

Tax Planning After The Gilti And Subpart F High-tax Exceptions in Schaumburg, Illinois

It is not a different legal entity.– See: Branch tax– Tax troubled branches of international firms along with the regular corporate earnings tax on the branch’s revenue. This is comparable to the tax on rewards which would certainly be due if the branch had actually been a subsidiary (see: subsidiary company) of the foreign business as well as had distributed its earnings as dividends.

Where expenditure is extra very closely gotten in touch with business income-earning framework than its income making ability, it is capital investment.– A gain on the sale of resources asset. A tax based upon resources holdings, instead of a capital gains tax.– To tape-record funding investments as enhancements to asset accounts, not as costs.

See: Price Contribution Arrangements Where the main management and control lies is a test for establishing the location of house of a company (form 5472 instructions). Broadly speaking, it refers to the highest level of control of the organization of a firm. This is just one of the criteria utilized to fix the problem of double residence of individuals.

International Wealth Tax Advisors, LLC

1270 6th Ave 7th floor,New York, NY 10020, USA

Comparison of regulated transaction problems with conditions dominating in deals in between independent ventures (unrestrained purchases). Managed and also unchecked deals are equivalent if none of the distinctions in between the transactions can materially impact the element being analyzed in the technique (e. g. rate or margin), or if reasonably exact adjustments can be made to eliminate the worldly impacts of any such distinctions.

No Comment