On top of that, the Act clears up that, about the banned transaction risk-free harbor, particular advertising and marketing as well as advancement tasks may be conducted not only via an independent service provider but also through a TRS. These modifications grant REITs a lot more versatility in regard of sales due to the fact that it enables the concentration of even more sales in one tax year than under the old regulations.

e., generally the fiscal year 2016). Under previous regulation, REIT shares, yet not REIT debt, have been good REIT assets for functions of the 75% possession examination. Under the Act, unsafe debt instruments issued by openly supplied REITs (i. e., provided REITs as well as public, non-listed REITs) are currently likewise treated as good REIT properties for purposes of the 75% asset test, however only if the value of those debt tools does not exceed 25% of the gross property value of the REIT.

This modification is reliable for tax years beginning after December 31, 2015. The logic of the cleansing policy is that the gain on the UNITED STATE actual residential property has currently been subject to one degree of UNITED STATE tax so there is no requirement for a second level of U.S. tax by way of straining the supply sale.

Proposed Regulations For Qualified Foreign Pension Funds … in Elyria, Ohio

As necessary, the Act supplies that the FIRPTA cleansing regulation does not apply to U.S. companies (or any of their predecessors) that have been REITs throughout the appropriate testing period. This change is relevant for tax years beginning after the date of the enactment of the Act (i. e., usually calendar year 2016).

The Act enhances the tax rate for that holding back tax to 15%. There are, for instance, other changes pertaining to personal home or hedging transactions.

We expect non-U (international tax consultant).S. pension plan plans will certainly raise their investments in U.S. genuine estate, including UNITED STATE infrastructure projects, offered this adjustment. Accordingly, foreign government capitalists that depend on Area 892 however that are not pension strategies will certainly not profit from this pension plan exception from FIRPTA.

We would anticipate to see less REIT offshoots in the near-term. It deserves noting that the Act did not embrace added anti “opco/propco” proposals that have targeted the lease contracts in between the operating firm and the residential property company. 5 Accordingly, it is most likely that the marketplace will think about alternate structures to achieve comparable results.

Us Irs Proposes Regulations On Firpta Tax Exception For … – Ey in Daly City, California

The brand-new certified investor exception from FIRPTA might affect the structuring of REIT M&A transactions. We will remain to keep track of these growths closely. If you have any type of inquiries regarding this Sidley Update, please call the Sidley lawyer with whom you usually work, or 1 All Section referrals are to the Internal Earnings Code of 1986 (the Code).

firm is dealt with as a USRPHC if 50% or even more of the reasonable market worth of all its service properties is attributable to UNITED STATE property. 3 Section 897(c)( 3 )(sales) and Section 897(h)( 1 )(ECI Distributions). 4 For this function, “qualified collective investment car” indicates an international person (a) that, under the comprehensive earnings tax treaty is eligible for a lowered rate of holding back relative to average dividends paid by a REIT even if such person holds even more than 10% of the supply of such REIT, (b) that (i) is an openly traded collaboration to which subsection (a) of Area 7704 does not apply, (ii) is a withholding foreign partnership, (iii) if such international collaboration were a United States company, would certainly be a USRPHC at any moment during the 5-year duration upright the date of personality of, or distribution relative to, such partnership’s interests in a REIT, or (c) that is marked as a qualified collective investment car by the Assistant as well as is either (i) fiscally clear within the meaning of Area 894, or (ii) required to consist of rewards in its gross earnings, yet entitled to a reduction for circulations to persons holding interests (besides interests solely as a lender) in such international person.

Founded in 2015 and located on Avenue of the Americas, in the heart of New York City, International Wealth Tax Advisors provides highly personalized, secure and private global tax, GILTI, FATCA, Foreign Trusts consulting and accounting to many clients worldwide, including: Singapore, China, Mexico, Ecuador, Peru, Brazil, Argentina, Saudi Arabia, Pakistan, Afghanistan, South Africa, United Kingdom, France, Spain, Switzerland, Australia and New Zealand.

To receive Sidley Updates, please subscribe at . Sidley Austin gives this info as a service to customers as well as various other pals for educational objectives only. It needs to not be understood or relied upon as legal advice or to produce a lawyer-client relationship. This Tax upgrade was not planned or written to be utilized, and also can not be utilized, by any person for the objective of staying clear of any UNITED STATE

Firpta Foreign Investment In Real Property Tax Act – Title … in Queens, New York

Readers should viewers act upon this Tax update without seeking advice from suggestions advisers. Additionally, this Tax upgrade was not planned or contacted be used, as well as can not be made use of, by anyone for the objective of avoiding any UNITED STATE government, state or regional tax charges that may be troubled such individual.

Any kind of count on, corporation, or various other company or setup will make up a “professional international pension strategy” and gain from this exemption if: it is created or organized under the law of a country other than the United States; it is established to provide retired life or pension benefits to individuals or recipients that are existing or former staff members (or persons designated by such employees) of one or more companies in factor to consider for services provided; it does not have a single participant or recipient with a right to even more than 5% of its properties or income; it goes through government guideline as well as supplies yearly info reporting concerning its beneficiaries to the appropriate tax authorities in the country in which it is developed or operates; as well as under the regulations of the country in which it is developed or runs either (i) contributions to it which would certainly otherwise go through tax under such laws are insurance deductible, left out from gross earnings or strained at a decreased price or (ii) taxes of any one of its investment revenue is deferred or exhausted at a decreased price (international tax consultant).

FIRPTA also usually relates to a distribution by a REIT or other certified investment entity (such as certain RICs) (“”) to a foreign individual, to the level the distribution is attributable to acquire from sales or exchanges of USRPIs by the REIT or various other QIE. An exemption exists for circulations of USRPIs that are relative to any type of frequently traded class of stock if the foreign individual did not in fact have more than 5% of such class of stock at any moment during the one year period ending on the distribution day.

Foreign Investment In U.s. Real Property Tax Services in Tamiami, Florida

tax treaty that consists of a contract for the exchange of info if that person’s principal course of rate of interests is detailed as well as consistently traded on several acknowledged supply exchanges; as well as an international partnership developed or arranged under international law as a limited collaboration in a jurisdiction that has a details exchange agreement with the United States, if that foreign collaboration: has a class of minimal collaboration units frequently traded on the NYSE or Nasdaq, preserves documents on the identification of 5% or better owners of such course of partnership systems, and also makes up a “competent cumulative financial investment vehicle” through being: qualified to tax treaty benefits with respect to normal reward circulations paid by a REIT, a publicly traded partnership that works as a withholding international partnership and also would certainly be a USRPHC if it were a domestic firm, or assigned as a certified cumulative investment vehicle in future Treasury Department advice.

In such an instance, the certified shareholder exception will be switched off and FIRPTA will apply relative to a percentage of the earnings from personalities of REIT stock by the qualified investor (and also REIT circulations to the certified investor) usually equivalent to the percent possession (by worth) held by appropriate investors in the certified investor.

For this purpose, domestic control needs that foreign persons in the aggregate hold, straight or indirectly, much less than 50% of the REIT or various other certified financial investment entity by value whatsoever pertinent times. Taxpayers as well as professionals alike have actually long been worried concerning how to make this possession decision when it comes to a publicly-traded REIT or various other QIE. international tax consultant.

individual unless the REIT or other QIE has real understanding that such individual is not an U.S. person; any supply held by an additional REIT or other QIE that either has a course of supply that is routinely traded on a well established protections market or is a RIC is dealt with as held by: a foreign person if the other REIT or other QIE is not locally controlled (identified after application of these brand-new policies), however a UNITED STATE

The Us Treasury Releases New Firpta Regulations – Jd Supra in Wheaton, Illinois

One more policy in the COURSE Act appears to provide, albeit in language that does not have quality (however is somewhat illuminated in the relevant Joint Committee on Tax), that a REIT distribution dealt with as a sale or exchange of stock under Areas 301(c)( 3 ), 302 or 331 of the Internal Income Code relative to a qualified shareholder is to make up a funding gain topic to the FIRPTA withholding tax if attributable to an applicable capitalist and also, but a routine returns if attributable to any various other individual.

United States tax legislation needs that all persons, whether international or residential, pay income tax on the disposition of UNITED STATE genuine residential or commercial property rate of interests. Domestic persons or entities commonly are subject to this tax as part of their regular revenue tax; however, the U.S. needed a means to accumulate taxes from foreign individuals on the sale of U.S

Firpta: Basics For Foreign Sellers And Real Estate Agents in Pontiac, Michigan

The amount held back is not the tax itself, but is repayment on account of the taxes that ultimately will be due from the vendor. international tax consultant.

If the sole participant is a “International Person,” after that the FIRPTA withholding policies apply in the exact same fashion as if the international single participant was the vendor. Multi-Member LLC: A domestic limited liability company with even more than one owner is not thought about a “Overlooked Entity” as well as is tired in different ways than single-member limited responsibility business.

International Wealth Tax Advisors, LLC

1270 6th Ave 7th floor,New York, NY 10020, USA

(212) 256-1142

Click here to book a consultation with International Wealth Tax Advisors about foreign trusts, Form 3520, Form 3520-A, FBAR (FinCEN 114), Form 8938, Form 5471, Form 8621, distributable net income calculations, undistributable net income calculations and beneficiary statements, etc.

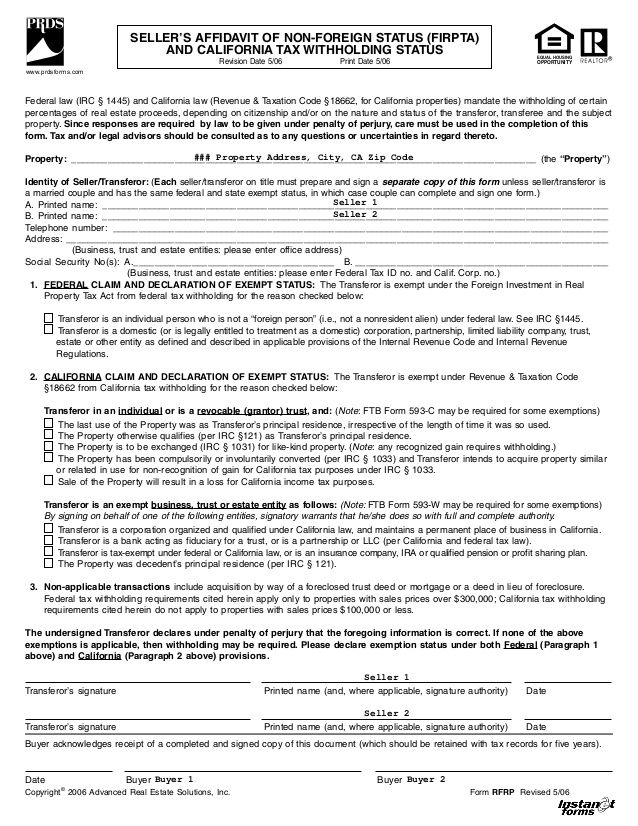

One of the most typical as well as clear exemptions under FIRPTA is when the vendor is not a Foreign Person. In this case, the vendor has to supply the purchaser with an affidavit that licenses the seller is not an International Individual and provides the vendor’s name, U.S.Under this exception, the buyer is not required to make this election, even if the facts may support the exemption or exemption rate and purchaser settlement agent should advise the buyer that, also, the truths might sustain reduced exception automatically decreased.

No Comment