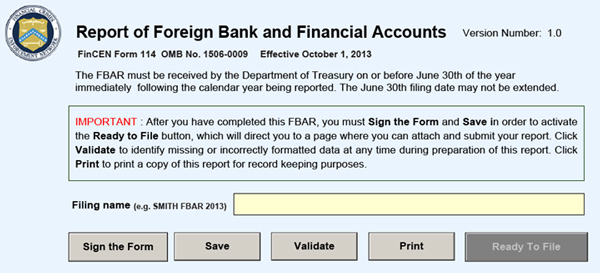

The day of a violation for failing to prompt data an FBAR is the end of the day on June 30th of the year adhering to the fiscal year for which the accounts are being reported. This day is the last possible day for filing the FBAR to ensure that the close of the day with no filed FBAR stands for the very first time that an offense happened.

Founded in 2015 and located on Avenue of the Americas, in the heart of New York City, International Wealth Tax Advisors provides highly personalized, secure and private global tax, GILTI, FATCA, Foreign Trusts consulting and accounting to many clients worldwide, including: Singapore, China, Mexico, Ecuador, Peru, Brazil, Argentina, Saudi Arabia, Pakistan, Afghanistan, South Africa, United Kingdom, France, Spain, Switzerland, Australia and New Zealand.

The date of an offense for failing to keep records is the day the inspector very first demands documents. The equilibrium in the account at the close of the day that the documents are initial asked for is the quantity used in determining the recordkeeping infraction fine. The date of the violation is linked to the date of the demand, as well as not a later date, to guarantee the taxpayer is not able to manipulate the amount in the account after getting a request for records.

Willfulness is shown by the person’s expertise of the coverage needs and the individual’s mindful choice not to abide by the demands. In the FBAR circumstance, the individual just require recognize that a reporting requirement exists. If an individual has that expertise, the only intent needed to constitute an unyielding infraction of the need is a mindful choice not to file the FBAR.

What Are Fbars And Why Do They Matter To The Irs? – Mir Tax in Beloit, Wisconsin

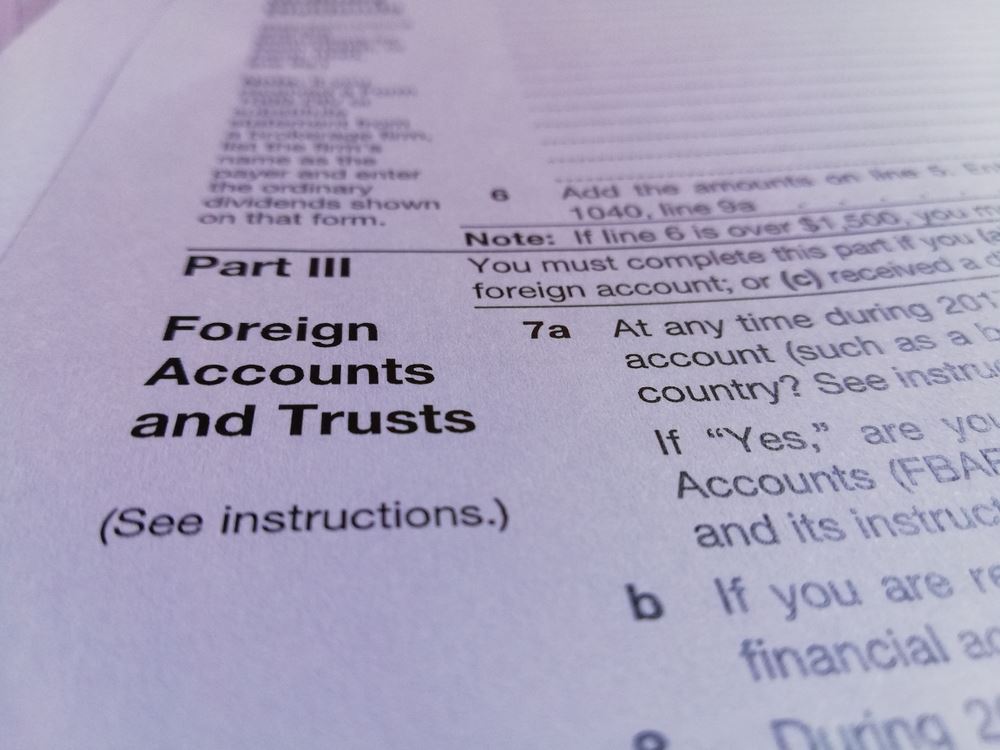

It is affordable to presume that a person who has international checking account must review the info specified by the government in tax return. The failure to act upon this information and also discover of the additional coverage need, as recommended on time B, might provide evidence of willful blindness for the person.

The simple truth that an individual checked the wrong box, or no box, on a Set up B is not adequate, by itself, to develop that the FBAR offense was attributable to willful blindness – non resident alien tax withholding. The complying with examples show scenarios in which willfulness might exist: An individual submits the FBAR, but omits one of three international bank accounts.

The person explains that the noninclusion was because of unintentional oversight. Throughout the assessment, the individual provides all information asked for with respect to the left out account. The info offered does not divulge anything questionable regarding the account, as well as the individual reported all revenue connected with the account on his tax return.

Us Department Of Treasury Mandates E-filing Of Fbar in Weston, Florida

An individual filed the FBAR in earlier years but failed to file the FBAR in succeeding years when needed to do so. When asked, the individual does not offer an affordable explanation for falling short to file the FBAR. On top of that, the person may have fallen short to report income related to foreign checking account for the years that FBARs were not submitted.

A person obtained a caution letter informing him of the FBAR filing need, but the individual remains to stop working to file the FBAR in subsequent years – non resident alien tax withholding. When asked, the individual does not provide a practical explanation for stopping working to submit the FBAR. In enhancement, the individual may have failed to report income related to the foreign savings account.

Declarations for debit or bank card from the offshore bank that, for instance, reveal the account owner used funds from the offshore account to cover everyday living expenditures in a manner that conceals the resource of the funds. Duplicates of any kind of FBARs submitted formerly by the account owner (or Fin, CEN Question printouts of FBARs).

What Are Fbars And Why Do They Matter To The Irs? – Mir Tax in Owensboro, Kentucky

Otherwise, note in the workpapers whether there was an opportunity to give such a statement. Copies of any kind of previous warning letters released or qualifications of previous FBAR fine assessments. An explanation, in the workpapers, regarding why the supervisor believes the failing to submit the FBAR was unyielding. Files available in an FBAR instance worked under a Related Law Decision under Title 26 that might be helpful in developing willfulness consist of: Copies of records from the management instance file (including the Income Representative Record) for the earnings tax exam that show income pertaining to funds in a foreign bank account was not reported.

Duplicates of tax returns (or RTVUEs or BRTVUs) for a minimum of 3 years prior to the opening of the overseas account and for all years after the account was opened, to reveal if a substantial decrease in reportable income took place after the account was opened up. (Testimonial of the 3 years’ returns before the opening of the account would certainly provide the examiner a much better suggestion of what the taxpayer may have generally reported as revenue before opening up the foreign account).

Two collections of cash T accounts (a reconciliation of the taxpayer’s sources as well as uses funds) with one set revealing any type of unreported income in foreign accounts that was recognized throughout the examination as well as the second collection excluding the unreported revenue in international accounts (non resident alien tax withholding). Any papers that would certainly sustain fraudulence (see IRM 4.

Foreign Bank Account Reporting (Fbar) Filing – Expat Cpa in Riverside, California

In no event will certainly the total penalty amount exceed 100 percent of the highest possible aggregate balance of all unreported foreign financial accounts during the years on trial. If an account is co-owned by more than one individual, a fine decision have to be made independently for each co-owner. The fine against each co-owner will certainly be based on his her percentage of ownership of the highest possible equilibrium in the account. non resident alien tax withholding.

The examiner might determine that the realities as well as scenarios of a specific instance do not warrant asserting a charge. When a fine is proper, Internal Revenue Service charge reduction standards help the supervisor in using fines in a consistent way. The examiner might establish that a charge under these standards is not proper or that a lower charge amount than the standards would otherwise provide is appropriate or that the charge must be increased (as much as the statutory maximum).

Aspects to think about when using examiner discernment might include, however are not limited to, the following: Whether compliance objectives would certainly be accomplished by issuance of a warning letter. Whether the person that dedicated the offense had actually been formerly issued a caution letter or assessed an FBAR fine. The nature of the offense as well as the amounts involved.

Fbar Filing Requirments 2021: What You Need To Know in Lakewood, California

Offered the magnitude of the maximum fines allowed for each offense, the assertion of several charges as well as the assertion of different charges for numerous offenses with regard to a single FBAR, must be carefully considered and also computed to ensure the amount of the charge is commensurate to the injury brought on by the FBAR violation.

The inspector should make this determination with the written authorization of that supervisor’s manager. The examiner’s workpapers have to record the scenarios that make reduction of the penalty under these standards proper. When figuring out the correct charge amount, the examiner ought to remember that manager authorization is called for to insist greater than one $10,000 non-willful charge annually, and also in no event can the aggregate non-willful penalties asserted go beyond 50% of the highest possible aggregate balance of all accounts to which the infractions associate during the years at concern.

To get mitigation, the person must fulfill 4 requirements: The person has no background of criminal tax or BSA convictions for the coming before ten years and also has no history of previous FBAR charge assessments. No money going through any one of the international accounts linked with the individual was from a prohibited resource or used to advance a criminal function.

Foreign Bank Account Reporting,fbar. What Does It Cost To … in Lafayette, Louisiana

The Level II-Willful Charge is For each and every make up which there was a violation, the higher of $5,000 or 10% of the maximum account equilibrium during the schedule year at problem. To Receive Degree III-Willful Determine Accumulation Balance If the maximum aggregate equilibrium for all accounts to which the infractions connect exceeds $250,000 however does not exceed $1,000,000, Degree III-Willful reduction uses to all offenses.

The Degree III-Willful Penalty is For each and every account for which there was an offense, the higher of 10% of the optimum account balance during the fiscal year at concern or 50% of the account balance on the day of the infraction. To Receive Level IV-Willful Determine Accumulation Equilibrium If the maximum aggregate equilibrium for all accounts to which the offenses connect goes beyond $1,000,000, Degree IV-Willful mitigation applies to all offenses.

The Level IV-Willful Penalty is For each and every represent which there was a violation, the higher of 50% of the balance in the account at the time of the offense or $100,000 (i. e., the statutory maximum fine). Money transmitters in the UNITED STATE send money abroad generally with the use of international financial institutions or non-bank agents found in international nations.

Does Your Child Need To File An Fbar? – Irs Medic in Sunrise Manor, Nevada

The UNITED STATE money transmitter cords funds to the foreign financial institution or non-bank representative and supplies guidelines to make settlements to the recipient situated in the international nation. The money transmitter typically does not have trademark or other authority over the agent’s savings account. In this scenario, the money transmitter is not called for to submit an FBAR for the agent’s financial institution account.

An additional person holding the international account in support of the cash transmitter does not negate the FBAR filing need. Frequently Asked Questions (FAQ’s): Is there an FBAR declaring need when the cash transmitter cords funds to an international checking account or has a company connection with somebody situated in a foreign nation? Answer: No.

Exists an FBAR filing need where the cash transmitter possesses a financial institution account located in an international country or has signature authority over somebody else’s checking account located in an international country? Solution: Yes, if the account went beyond $10,000 at any moment throughout the calendar year as well as the money transmitter was a United States person for FBAR purposes.

Fbar – Edelman Tax Llc in Southaven, Mississippi

The money transmitter’s partnership with a foreign associate, on its own, does not produce an FBAR declaring need. Nonetheless, if the money transmitter possessed a checking account situated in an international country or had trademark authority over another person’s savings account situated in a foreign country, was a United States individual, as well as the account worth went beyond $10,000 at any moment, the cash transmitter would certainly be needed to file an FBAR.

A distinction, however, must be attracted in between having authority over a checking account of a non-bank international agent and commanding over an international agent who owns an international savings account. Having authority over an individual that possesses a foreign checking account is not the exact same as having authority over a foreign savings account.

The cash transmitter does not have a financial interest in a foreign economic account. A “monetary account” for FBAR filing functions includes savings account, financial investment accounts, interest-bearing accounts, demand checking, bank account, time down payments, or any type of other account maintained with a banks or various other person participated in business of a banks.

Foreign Bank Account Reporting,fbar. What Does It Cost To … in Beaumont, Texas

Accounts held in commingled funds (common funds) as well as the account owner holds an equity interest in the fund. Independently possessed bonds, notes, stock certificates, as well as unprotected financings are not “accounts”.

This is wrong. Keep in mind, if the highest accumulated value of all of the foreign accounts on any kind of day in the tax year mores than $10,000, after that all accounts have to be reported on the FBAR. Another usual error emerges when an account beneficially comes from an additional person. In this instance it is often mistakenly thought that the nominee does not need to report that account on an FBAR.

Other blunders include an incorrect understanding regarding what has to be divulged on the FBAR. International common funds or foreign life insurance coverage/ international annuity with a cash abandonment value have to be reported. An additional common blunder includes the wrong notion concerning submitting for an expansion. If one is to submit an extension for one’s US tax return it will certainly also expand the due day for the FBAR declaring.

Do I Need To File Fbar If I Didn’t Earn Any Interest ? – – Sanjiv … in Arvada, Colorado

International Wealth Tax Advisors, LLC

1270 6th Ave 7th floor,New York, NY 10020, USA

On top of that, one can not acquire an expansion to submit an FBAR. This will alter for FBARs covering the 2016 year, due in 2017. You can check out a lot more below. Overseas Americans who have gone down out of the tax filing system can be in a perilous circumstance. Most of them will have foreign (non-US) financial institution and/or monetary accounts for which FBARs need to have been filed.

No Comment